Cryptocurrency exchanges are platforms where users can buy, sell, and trade digital currencies. These platforms facilitate the conversion of cryptocurrencies into other digital or traditional currencies.

They offer various features such as secure wallets, real-time trading, and diverse cryptocurrency options. With increasing popularity and the potential for substantial returns, cryptocurrency exchanges have become an integral part of the digital finance ecosystem. Whether you are a seasoned investor or a beginner exploring the world of cryptocurrencies, choosing the right exchange is crucial for a seamless and secure trading experience.

We will delve into the key factors to consider when selecting a cryptocurrency exchange and discuss some of the most popular exchanges in the market.

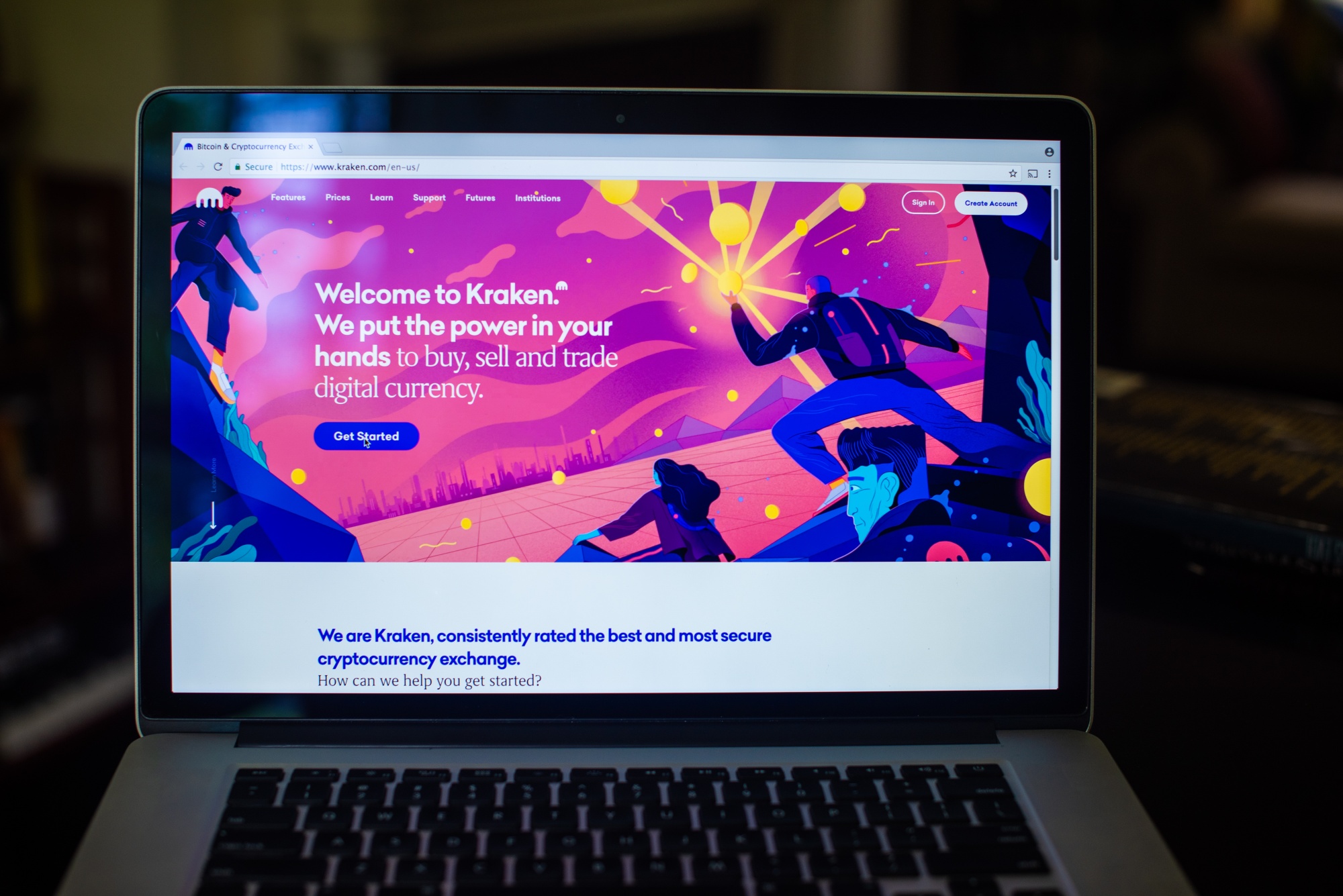

Credit: www.bloomberg.com

What Are Cryptocurrency Exchanges?

Cryptocurrency exchanges facilitate the trading of digital currencies, allowing users to buy and sell various cryptocurrencies. These platforms provide a secure and efficient way to exchange cryptocurrencies, empowering individuals to participate in the growing crypto market.

Cryptocurrency Exchanges: Definition And Importance In Trading

Cryptocurrency exchanges play a vital role in the world of digital currencies. They serve as platforms where individuals can buy, sell, and trade various cryptocurrencies. These exchanges provide a secure and efficient way for users to engage in crypto transactions.

Now, let’s dive deeper into the definition and importance of cryptocurrency exchanges.

Definition And Brief Explanation

Cryptocurrency exchanges refer to online platforms that allow users to trade cryptocurrencies in exchange for other digital assets or even traditional currencies such as the US dollar or the Euro. These exchanges act as intermediaries, connecting buyers and sellers from around the world.

Here are some key points to understand about cryptocurrency exchanges:

- They provide a marketplace for buying and selling: Cryptocurrency exchanges facilitate transactions between users who want to buy or sell cryptocurrencies. They enable individuals to exchange their digital assets for other cryptocurrencies or convert them into fiat currencies.

- They offer trading pairs: Cryptocurrency exchanges provide a wide range of trading pairs, allowing users to convert one cryptocurrency into another. For example, users can trade Bitcoin for Ethereum or vice versa. This extensive selection of trading pairs enhances the liquidity and flexibility of the crypto market.

- They implement security measures: Cryptocurrency exchanges prioritize the security of user funds and personal information. They employ advanced encryption techniques, two-factor authentication, and cold storage wallets to protect against hacking attempts and unauthorized access.

Importance Of Cryptocurrency Exchanges In Trading

Cryptocurrency exchanges play a crucial role in the crypto ecosystem. Here’s why they are important for traders and cryptocurrency enthusiasts:

- Liquidity: Cryptocurrency exchanges provide a platform with high liquidity, meaning there is a significant volume of buyers and sellers. This liquidity ensures that traders can easily enter or exit positions with minimal price slippage. It also enables individuals to quickly convert their cryptocurrencies into other assets when needed.

- Price discovery: Since cryptocurrency exchanges act as marketplaces, they facilitate price discovery. Through the collective buying and selling activity on these exchanges, the market determines the value of various cryptocurrencies. Traders can monitor price movements and make informed decisions based on real-time data.

- Trading tools and features: Cryptocurrency exchanges offer a range of tools and features that enhance the trading experience. These include order types such as market orders, limit orders, and stop orders, as well as charting tools, trading bots, and margin trading options. These features empower traders to execute their strategies effectively.

- Accessibility: Cryptocurrency exchanges provide easy access to the crypto market for individuals around the world. They eliminate barriers such as geographical boundaries and complex financial intermediaries. Anyone with an internet connection can create an account and start trading cryptocurrencies, making it a decentralized and inclusive market.

- Innovation and growth: Cryptocurrency exchanges drive innovation and foster the growth of the crypto industry. They serve as hubs for new token listings, initial coin offerings (ICOs), and decentralized finance (DeFi) projects. By providing a platform for these advancements, exchanges contribute to the overall development of the digital asset ecosystem.

Cryptocurrency exchanges are online platforms that enable users to trade cryptocurrencies. They offer liquidity, price discovery, and a range of tools that enhance the trading experience. These exchanges play a crucial role in the growth and development of the crypto industry, serving as gateways for individuals to participate in the digital asset market.

Choosing The Right Cryptocurrency Exchange

Choosing the right cryptocurrency exchange is essential for secure and hassle-free trading. Find the perfect platform to buy, sell, and store your digital assets with confidence.

When stepping into the world of cryptocurrencies, one of the first decisions you’ll need to make is choosing the right cryptocurrency exchange. This crucial choice can impact your trading experience, security, and the range of cryptocurrencies available to you. To help you make an informed decision, consider the following factors when selecting an exchange:

Factors To Consider When Selecting An Exchange:

- Security measures in place: Ensuring that your funds and personal information are safe is paramount when engaging in cryptocurrency trading. Look for exchanges that implement robust security measures such as two-factor authentication, encryption, and cold storage for funds.

- Available cryptocurrencies and trading pairs: The variety of cryptocurrencies available on an exchange is an important consideration. Make sure the exchange offers a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Litecoin. Additionally, check if the exchange provides trading pairs that align with your investment goals.

- User interface and trading tools: A user-friendly interface and comprehensive trading tools can greatly enhance your trading experience. Look for exchanges that offer intuitive platforms with clear navigation and customizable options. Additionally, explore the available technical analysis tools, charts, and order types that the exchange provides.

By evaluating these factors, you can choose an exchange that matches your security requirements, trading preferences, and investment goals. Happy trading!

Getting Started With A Cryptocurrency Exchange

Get started with a cryptocurrency exchange to explore the world of digital currencies. Discover a user-friendly platform where you can buy, sell, and trade cryptocurrencies securely and conveniently. Join the fast-growing community of crypto enthusiasts and venture into the exciting realm of virtual currencies.

Creating An Account:

Creating an account on a cryptocurrency exchange is an essential first step in getting started with trading digital currencies. Here’s what you need to know:

- Visit the website of the chosen cryptocurrency exchange.

- Look for the ‘Sign-Up’ or ‘Register’ button and click on it.

- Fill in the required information, such as your email address, username, and password.

- Make sure to choose a strong password that includes a combination of uppercase and lowercase letters, numbers, and special characters.

- Some exchanges may require additional personal information for verification purposes.

- Check the terms and conditions, and if you agree, proceed to create your account.

Completing The Verification Process:

To comply with anti-money laundering (AML) and know your customer (KYC) regulations, most cryptocurrency exchanges require users to complete a verification process. This process helps ensure the security and legitimacy of the platform and its users. Here’s how it typically works:

- Login to your newly created account and locate the verification section.

- Provide the necessary personal information, such as your full name, date of birth, and address.

- Upload a scanned copy or photo of a government-issued identification document, such as a passport or driver’s license.

- Some exchanges may also require additional documents, such as proof of address, a selfie with your identification, or a video verification.

- Wait for the exchange to review your verification application, which can take anywhere from a few hours to a few days.

- Once approved, you can enjoy higher transaction limits and additional features offered by the exchange.

Setting Up Two-Factor Authentication For Enhanced Security:

Two-factor authentication (2FA) adds an extra layer of security to your cryptocurrency exchange account. By enabling 2FA, you are required to provide an additional piece of information, usually a temporary code, along with your username and password when logging in.

Follow these steps to set up 2FA:

- Go to the security settings or account settings section of the exchange platform.

- Look for the 2FA or Two-Factor Authentication option and select it.

- Choose your preferred method of 2FA, such as using an authenticator app like Google Authenticator or receiving SMS codes.

- Follow the instructions provided to link your chosen 2FA method to your exchange account.

- Once set up, every time you log in, you will need to enter the temporary code generated by your chosen 2FA method in addition to your regular login credentials.

- With 2FA enabled, your account will be more secure against unauthorized access.

Funding Your Account And Deposit Options:

Now that your account is set up, you’ll need to fund it in order to start trading cryptocurrencies. Different exchanges offer various deposit options, so be sure to select the one that works best for you. Here are some common ways to fund your cryptocurrency exchange account:

- Bank transfer: This option allows you to transfer funds directly from your bank account to the exchange. It is usually the most common and preferred method due to its security and convenience.

- Credit or debit card: Some exchanges accept credit or debit card payments, allowing you to quickly deposit funds. Keep in mind that using cards may come with additional fees.

- Cryptocurrency transfer: If you already own digital currencies, you can transfer them from another wallet to your exchange account. This option is usually fast and can offer lower transaction fees.

- Payment processors: Certain exchanges accept payments through third-party payment processors such as PayPal or Skrill. Be aware that these options might involve higher fees.

Before depositing, be sure to check the fees associated with each deposit method and any applicable minimum deposit requirements. This will help you choose the most cost-effective and convenient option for funding your account.

Remember, getting started with a cryptocurrency exchange involves creating an account, completing the verification process, setting up two-factor authentication, and funding your account. By following these steps, you’ll be well on your way to exploring the exciting world of digital currencies and trading on a secure platform.

Understanding Different Order Types

Understanding different order types is crucial for navigating cryptocurrency exchanges. From market orders to limit orders and stop orders, each type provides different strategies for buying and selling digital assets. Mastering these order types is essential for successful trading in the cryptocurrency market.

Cryptocurrency Exchanges

Cryptocurrency exchanges play a vital role in facilitating the buying and selling of digital assets. As a trader or investor, understanding different order types is essential to navigate these platforms effectively. In this section, we will explore the four main order types commonly used: Market orders, Limit orders, Stop-loss orders, and Take-profit orders.

Market Orders

- Market orders are straightforward and commonly used by traders looking for immediate execution of their trades.

- When placing a market order, you are essentially buying or selling a cryptocurrency at the current market price, regardless of the price fluctuations or potential slippage.

- This type of order guarantees quick execution, but it does not provide control over the price at which the trade is executed.

- Market orders are suitable for traders who prioritize speed over setting specific price levels.

Limit Orders

- Limit orders allow traders to specify the price at which they want to buy or sell a cryptocurrency.

- When placing a buy limit order, you set a price lower than the current market price. The order will be executed when the cryptocurrency reaches or falls below your specified price.

- On the other hand, a sell limit order is placed at a price higher than the current market price. The trade will be executed when the cryptocurrency reaches or surpasses that price level.

- Limit orders provide more control over the execution price but do not guarantee immediate execution, as the market needs to reach the specified price level.

Stop-Loss Orders

- Stop-loss orders are risk management tools designed to limit potential losses.

- By setting a stop-loss order, you can establish a price level at which a cryptocurrency position will be automatically sold to minimize losses.

- When the market reaches or falls below the specified stop-loss price, the order is triggered, converting your position into cash.

- Stop-loss orders are commonly used to protect profits or mitigate risks by limiting potential losses if the market moves against your position.

Take-Profit Orders

- Take-profit orders are the opposite of stop-loss orders and are used to secure profits.

- By setting a take-profit order, you establish a price level at which your cryptocurrency position will be automatically sold to lock in gains.

- When the market reaches or surpasses the specified take-profit price, the order is executed, ensuring that you don’t miss out on potential profits.

- Take-profit orders are instrumental in managing trades and capturing profits automatically, especially when you cannot actively monitor the market.

Understanding these different order types is crucial for successful trading on cryptocurrency exchanges. Market orders provide immediate execution, while limit orders allow traders to set specific price levels. Stop-loss orders help manage risks, and take-profit orders secure profits. With this knowledge, you are well-equipped to navigate the dynamic world of cryptocurrency trading.

Tips For Successful Trading On Cryptocurrency Exchanges

Discover essential tips for successful trading on cryptocurrency exchanges. Learn how to navigate the fast-paced world of cryptocurrencies and optimize your trading strategies for the best possible outcomes.

Setting Realistic Goals And Managing Risk:

- Before diving into cryptocurrency trading, it is crucial to set realistic goals and manage risk effectively. Setting clear objectives will help you stay focused and motivated throughout your trading journey.

- Determine how much you are willing to invest and be prepared for potential losses. Remember that cryptocurrency markets can be highly volatile, so it is essential to only invest what you can afford to lose.

- Be realistic about your profit expectations and avoid getting carried away by the excitement of the market. By setting achievable goals and managing risk appropriately, you can increase your chances of successful trading.

Conducting Thorough Research Before Making Trades:

- Research is a fundamental aspect of successful cryptocurrency trading. Before making any trade, take the time to gather as much information and insights as possible.

- Familiarize yourself with the specific cryptocurrency you’re interested in trading and understand its technology, market value, and potential risks.

- Keep up with trustworthy news sources, follow influential figures and influencers in the industry, and join relevant online communities to stay updated on the latest trends and developments.

- Conducting thorough research allows you to make informed decisions and reduces the likelihood of impulsive and uninformed trades.

Keeping Up With Market Trends And News:

- To navigate the cryptocurrency market successfully, it is essential to stay informed about market trends and news. Stay updated on the latest happenings and any significant events that could impact the market.

- Regularly follow cryptocurrency news outlets, subscribe to newsletters, and join social media communities focused on cryptocurrencies. This way, you can keep track of changes in regulations, technological advancements, and emerging trends.

- Analyzing market trends and news allows you to identify potential opportunities and make informed trading decisions based on real-time information.

Utilizing Stop-Loss And Take-Profit Orders Effectively:

- Stop-loss and take-profit orders are powerful tools that can help manage risk and maximize profits in cryptocurrency trading.

- A stop-loss order sets a predefined price at which your trade will automatically sell if the market moves against you. This helps limit potential losses and protect your investment.

- On the other hand, a take-profit order sets a target price at which your trade will automatically sell to secure profits.

- By utilizing these orders effectively, you can minimize emotional decision-making and maximize your potential gains while reducing potential losses.

Monitoring Your Trades And Adjusting Strategies As Needed:

- Monitoring your trades is crucial for successful cryptocurrency trading. Regularly track the progress of your trades and evaluate their performance against your goals and strategies.

- Keep an eye on market conditions and be prepared to adjust your strategies accordingly. Flexibility is key in the cryptocurrency market, as trends can change rapidly.

- Analyze both successful and unsuccessful trades to learn from your experiences and refine your trading strategies over time.

- By continuously monitoring and adjusting your trades and strategies, you can adapt to market changes and increase your chances of successful trading outcomes.

Staying Safe On Cryptocurrency Exchanges

Stay safe on cryptocurrency exchanges by following these essential steps: research and choose reputable exchanges, enable two-factor authentication, use hardware wallets for storage, regularly update software and security measures, and be cautious of phishing attempts or suspicious links. Protecting your investments is crucial in the volatile world of cryptocurrencies.

Cybersecurity is of paramount importance when it comes to cryptocurrency exchanges. With the increasing popularity and value of cryptocurrencies, hackers are continually devising new ways to exploit vulnerabilities and steal digital assets. To ensure the safety of your funds and personal information, it is crucial to implement strong security measures for your account, store your cryptocurrencies offline in hardware wallets, avoid suspicious links and phishing attempts, and conduct due diligence on new coins and projects.

Let’s explore these aspects in further detail:

Implementing Strong Security Measures For Your Account:

- Enable two-factor authentication (2FA) to add an extra layer of security to your account. This typically involves a combination of a password and a unique verification code sent to your phone or email.

- Use a strong and unique password, composed of a mix of letters, numbers, and symbols. Avoid using easily guessable information, such as your name or birthdate.

- Regularly update your password and avoid sharing it with anyone. Using a password manager can simplify the task of maintaining strong passwords for different accounts.

- Be cautious of public Wi-Fi networks as they may expose your login information to potential attackers. Always use a secure and private network when accessing your cryptocurrency exchange account.

Safely Storing Your Cryptocurrencies Offline In Hardware Wallets:

- Hardware wallets are physical devices designed to securely store your cryptocurrencies offline. They offer an extra layer of protection by keeping your private keys offline and disconnected from the internet.

- When using a hardware wallet, ensure that you purchase it directly from the manufacturer or authorized resellers to reduce the risk of tampering or pre-installed malware.

- Carefully follow the setup instructions provided by the hardware wallet manufacturer to ensure proper initialization and backup of your wallet. Backup your wallet’s recovery seed phrase in a safe and secure location.

- Avoid storing your cryptocurrency assets solely on exchange platforms as they may be vulnerable to hacking attempts. Transfer your assets to your hardware wallet for long-term storage to minimize the risk of theft.

Avoiding Suspicious Links And Phishing Attempts:

- Be wary of unsolicited emails, messages, or advertisements that claim to be from your cryptocurrency exchange. These could be phishing attempts aimed at tricking you into revealing your login credentials or other sensitive information.

- Always verify the legitimacy of a link before clicking on it. Hover your mouse over the link to check the destination URL and ensure that it matches the official website address of your cryptocurrency exchange.

- Type the exchange’s website URL directly into your browser or use bookmarks to access it, rather than relying on search engine results or clicking on unfamiliar links.

- Install reputable antivirus and anti-malware software on your devices to help detect and prevent phishing attempts.

Conducting Due Diligence On New Coins And Projects:

- Before investing in a new cryptocurrency or participating in an initial coin offering (ICO), conduct thorough research to assess the project’s legitimacy and potential risks.

- Review the project’s whitepaper, team members, advisors, and development roadmap to gain insights into its goals and feasibility.

- Check for any red flags by looking for user reviews, discussions on cryptocurrency forums, and news about the project.

- Consider consulting professionals or seeking advice from experienced cryptocurrency investors to minimize the risk of falling victim to scams or fraudulent projects.

By implementing these strong security measures, securely storing your cryptocurrencies offline in hardware wallets, avoiding suspicious links and phishing attempts, and conducting due diligence on new coins and projects, you can significantly reduce the risk of becoming a victim of cyber attacks or scams in the world of cryptocurrency exchanges.

Stay vigilant and prioritize the safety of your digital assets.

Exploring Advanced Trading Features

Discover the advanced trading features of cryptocurrency exchanges, unlocking opportunities for seamless transactions and strategic investments. Elevate your trading experience with enhanced tools and functionalities, empowering you to navigate the volatile cryptocurrency market with confidence.

Cryptocurrency Exchanges:

Engage with the world of cryptocurrency trading like never before! In this section, we will delve into the exciting world of advanced trading features offered by cryptocurrency exchanges. From margin trading and leverage to trading with futures contracts, and even using trading bots and automated strategies, we’ll explore the possibilities that await you.

Margin Trading And Leverage:

- Maximize your trading potential with margin trading and leverage.

- Increase your buying power by borrowing funds from the exchange.

- Trade with leverage to amplify your potential profits, though keep in mind the risks involved.

- Leverage allows you to control larger positions with a smaller investment.

Trading With Futures Contracts:

- Take your trading to the next level with futures contracts.

- Lock in the price of a cryptocurrency for future delivery.

- Speculate on the future value of a cryptocurrency without owning the underlying asset.

- Benefit from the ability to short, or bet against, the price of a cryptocurrency.

Using Trading Bots And Automated Strategies:

- Save time and optimize your trading activities with the help of trading bots and automated strategies.

- Utilize pre-programmed algorithms to execute trades on your behalf.

- Take advantage of market trends and opportunities even when you’re not actively monitoring the markets.

- Implement stop-loss orders and profit targets to manage your risk and ensure disciplined trading.

With these advanced trading features at your fingertips, you can explore new horizons and expand your trading prowess. Remember, however, that while these features offer great potential, it’s crucial to approach them with caution and a sound understanding of the risks involved.

Get ready to take your cryptocurrency trading to new heights!

Stay tuned for the next section where we’ll discuss the importance of security when it comes to cryptocurrency exchanges.

Best Practices For Tax Reporting And Compliance

Cryptocurrency exchanges must adhere to best practices for tax reporting and compliance, ensuring accurate and transparent financial records. These practices include documenting all transactions, reporting capital gains, and keeping up with changing regulations to maintain regulatory compliance.

Understanding Tax Obligations For Cryptocurrency Trading

Cryptocurrency trading can be exciting and lucrative, but it’s essential to understand the tax obligations that come with it. To ensure you stay on the right side of the law, here are some key points to consider:

- Cryptocurrency is considered property by the Internal Revenue Service (IRS), which means that it is subject to capital gains tax. Whether you’re trading, selling, or using crypto to make purchases, any gains or losses must be reported.

- Be aware of the holding period for your cryptocurrency. If you hold a particular cryptocurrency for less than a year before selling or trading it, it will be classified as a short-term capital gain or loss. On the other hand, if you hold it for over a year, it will be regarded as a long-term capital gain or loss.

- Different countries may have varying tax regulations concerning cryptocurrencies, so make sure to research and understand the tax laws in your jurisdiction. Consult with a tax professional or accountant to ensure compliance with local regulations.

Keeping Track Of Your Trades And Transactions

Accurate record-keeping is crucial when it comes to cryptocurrency trading and tax reporting. Here are some best practices to keep track of your trades and transactions:

- Maintain a detailed record of every cryptocurrency transaction you make, including dates, amounts, and the associated cost basis. This information will help calculate your gains or losses accurately.

- Use cryptocurrency exchange platforms that provide transaction history reports. These reports can be valuable when reconciling your trading activity and verifying the accuracy of your records.

- Organize your records by creating folders or spreadsheets. Categorize your trades, transfers, and other transactions for easier retrieval and reference when preparing your tax reports.

- Consider using a dedicated cryptocurrency tax software or service. These tools can automate the process of calculating gains and losses, generate tax reports, and help ensure compliance with tax regulations.

Utilizing Tax Reporting Tools And Services

Managing your cryptocurrency tax reporting can be complex, but there are tools and services available to simplify the process. Here’s how you can make the most of them:

- Research and choose a reliable cryptocurrency tax software or service that suits your needs. Look for features like automated transaction importing, tax form generation, and integration with popular cryptocurrency exchanges.

- Import your transaction data into the tax reporting tool. This eliminates manual data entry and minimizes the chance of errors.

- Review the generated tax reports to ensure accuracy. Check that all transactions are accounted for and properly classified as short-term or long-term gains or losses.

- Seek professional advice if you have complex trading activities or significant investments in cryptocurrencies. A tax professional or accountant can provide expert guidance and help ensure compliance with tax laws.

Remember, accurate tax reporting and compliance are essential when trading cryptocurrencies. By understanding your tax obligations, keeping thorough records, and utilizing tax reporting tools and services, you can navigate the tax landscape with confidence.

Evaluating The Pros And Cons Of Centralized And Decentralized Exchanges

When considering cryptocurrency exchanges, it’s crucial to weigh the advantages and disadvantages of centralized and decentralized platforms. Evaluation of both options is key to making informed decisions.

Cryptocurrency exchanges play a vital role in the world of digital currencies, providing individuals with a platform to buy, sell, and trade cryptocurrencies. These exchanges can be broadly categorized into two types: centralized exchanges and decentralized exchanges. Each type carries its own set of advantages and disadvantages.

In this section, we will delve into the pros and cons of centralized and decentralized exchanges to help you make an informed decision.

Centralized Exchanges: Advantages And Disadvantages

Centralized exchanges are the most common type of cryptocurrency exchange, acting as intermediaries between buyers and sellers. Here are the advantages and disadvantages of centralized exchanges:

Advantages:

- Ease of use: Centralized exchanges are generally user-friendly, providing simple and intuitive interfaces that cater to both beginner and experienced traders.

- Liquidity: These exchanges often have high trading volumes, ensuring that you can easily buy or sell cryptocurrencies at any given time.

- Wide range of cryptocurrencies: Centralized exchanges typically offer a wide variety of cryptocurrencies, giving you the flexibility to trade different digital assets.

- Fiat support: Many centralized exchanges support fiat currencies, allowing you to directly deposit or withdraw your local currency.

Disadvantages:

- Security risks: With centralized exchanges, your funds are held in a centralized wallet controlled by the exchange, making them vulnerable to security breaches and hacking attempts.

- Privacy concerns: Centralized exchanges usually require users to provide personal information for identity verification, raising privacy concerns for those who value anonymity.

- Dependency on the exchange: When using a centralized exchange, you are heavily reliant on the platform’s uptime and operational efficiency. System downtimes and technical glitches can hinder your trading activities.

Decentralized Exchanges: Benefits And Limitations

Decentralized exchanges (DEX) are designed to operate without a central authority, using smart contracts and blockchain technology to facilitate peer-to-peer trading. Let’s explore the benefits and limitations of decentralized exchanges:

Benefits:

- Enhanced security: In a DEX, you have control over your funds as they are stored in your personal wallet, reducing the risk of centralized hack attempts.

- Anonymity: With the absence of identity verification requirements, decentralized exchanges offer a higher level of privacy and anonymity for users.

- Resilience: Decentralized exchanges operate on a distributed network, making them less susceptible to downtime and system failures.

- Censorship resistance: DEX platforms cannot be easily regulated or shut down, ensuring that users have the freedom to trade without intervention.

Limitations:

- Lower liquidity: Compared to centralized exchanges, decentralized exchanges often have lower trading volumes, leading to potential liquidity issues for certain cryptocurrencies.

- Complexity: Using DEX platforms may require a deeper understanding of blockchain technology and smart contracts, making them less beginner-friendly.

- Limited asset selection: Decentralized exchanges typically have a narrower range of available cryptocurrencies compared to centralized exchanges.

- Slower transaction speeds: Transactions on decentralized exchanges can be slower due to the need for consensus in the blockchain network.

By carefully weighing the pros and cons of centralized and decentralized exchanges, you can determine which type aligns with your priorities and trading style. Ultimately, the choice between the two depends on your personal preferences regarding convenience, security, privacy, and the specific cryptocurrencies you wish to trade.

Diversifying Your Portfolio Through Cryptocurrency Exchanges

Diversify your portfolio by exploring the potential of cryptocurrency exchanges, a platform for trading various digital currencies. Expand your investment options and stay ahead in the evolving world of finance.

Investing in cryptocurrencies can be an exciting and potentially lucrative venture. However, it is essential to diversify your portfolio to ensure you are managing risk effectively and maximizing your returns. Cryptocurrency exchanges provide a platform to explore different cryptocurrencies, manage risk through diversification, and consider long-term investment strategies.

Exploring Different Cryptocurrencies And Their Potential

Cryptocurrency exchanges offer a wide range of digital currencies that you can explore to diversify your portfolio. Here are some key points to consider when exploring different cryptocurrencies:

- Research various cryptocurrencies: Familiarize yourself with the different cryptocurrencies available on the exchange and the technology behind them.

- Consider market dynamics: Evaluate market trends, trading volumes, and historical data to identify cryptocurrencies with potential for growth.

- Analyze project fundamentals: Examine the project’s goals, team, partnerships, and development updates to gauge its long-term viability.

- Evaluate risk-reward ratios: Assess the potential risks and rewards associated with investing in each cryptocurrency to make informed decisions.

Managing Risk Through Diversification

Diversification is crucial when investing in cryptocurrencies to mitigate the impact of market volatility. Here are some ways to manage risk through diversification:

- Allocate investments across different cryptocurrencies: By investing in a variety of cryptocurrencies, you spread your risk and reduce the impact of any one investment’s downturn.

- Balance high-risk and low-risk cryptocurrencies: Diversify your portfolio by including both established cryptocurrencies with a proven track record and promising up-and-coming projects.

- Consider geographical diversification: Explore cryptocurrencies from different regions to reduce the risk of being overly exposed to regulatory changes or market-specific issues.

Considering Long-Term Investment Strategies

While day trading and short-term investments can be tempting, it is essential to consider long-term investment strategies to maximize your cryptocurrency portfolio’s potential. Here are some factors to keep in mind:

- Evaluate project vision and roadmap: Look for cryptocurrencies with a clear vision and long-term roadmap, indicating potential for growth and innovation.

- Assess community support: Consider the strength and engagement of the cryptocurrency’s community, as they are instrumental in driving adoption and development.

- Monitor market trends: Stay informed about industry trends, regulatory developments, and overall market sentiment to make well-informed decisions.

- Strategize entry and exit points: Determine your investment thresholds, target returns, and stop-loss points to implement a disciplined investment strategy.

By diversifying your portfolio through cryptocurrency exchanges, exploring different cryptocurrencies, managing risk through diversification, and considering long-term investment strategies, you can position yourself for success in the volatile yet exciting world of digital currencies. Remember to stay updated, conduct thorough research, and monitor your investments regularly to adapt to changing market conditions.

Frequently Asked Questions For Cryptocurrency Exchanges

Which Exchange Is Best For Buying Cryptocurrency?

The best exchange for buying cryptocurrency depends on your preferences and needs.

What Is The Best Safest Crypto Exchange?

The best and safest crypto exchange is subjective and varies based on individual needs and preferences.

How Many Crypto Currency Exchanges Are There?

There are various cryptocurrency exchanges available, but the exact number is constantly changing.

What Is A Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform where you can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and others. It acts as an intermediary between buyers and sellers, providing a secure and convenient way to exchange digital currencies.

Conclusion

To recap, cryptocurrency exchanges play a crucial role in the world of digital currencies. These platforms provide a secure and convenient way for individuals to buy, sell, and trade cryptocurrencies. With their user-friendly interfaces and advanced security features, exchanges have made it easier for both novice and experienced investors to enter the crypto market.

The wide range of available cryptocurrencies ensures that investors have ample choices to diversify their portfolios. Moreover, the integration of innovative technologies, such as blockchain and artificial intelligence, has further enhanced the efficiency and transparency of these exchanges. As the popularity of cryptocurrencies continues to soar, it is imperative for investors to carefully select a reputable exchange that aligns with their goals and preferences.

Understanding the various factors to consider, such as security measures, available trading pairs, and customer support, will empower investors to make informed decisions. Ultimately, cryptocurrency exchanges serve as the gateway to the world of digital assets, offering immense potential for financial growth and innovation.